One website I look at quite regularly is called “thepointsguy.com” – it mainly focuses on ways to use points/miles to maximize travel benefits. This article about credit card payoffs and credit scores caught my attention:

Is there a downside to paying off a credit card balance before the billing cycle ends? I do this regularly, but I wonder if I should wait for the statement to close for it to get reported.

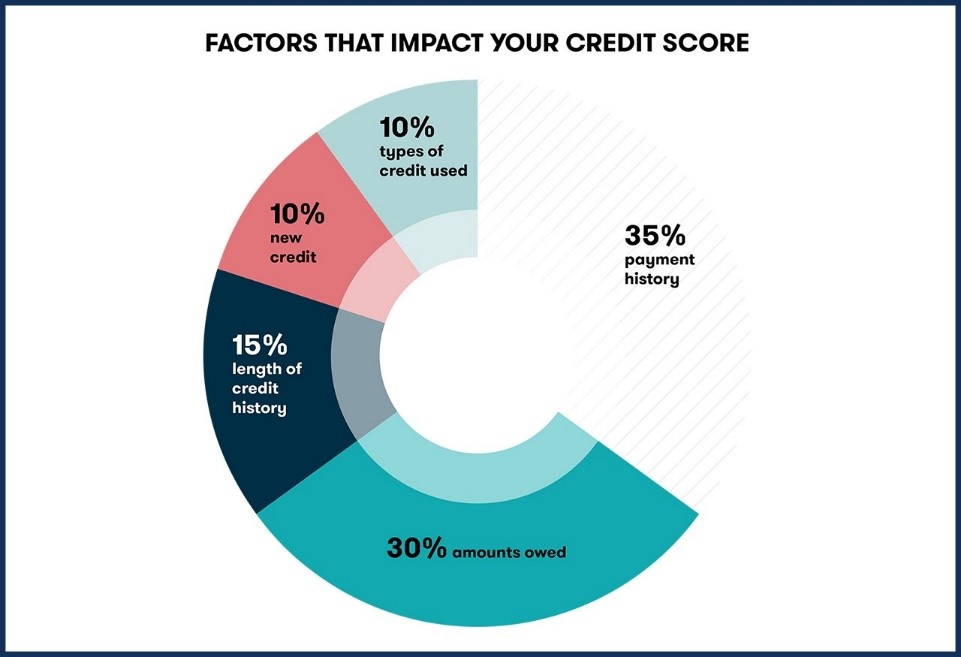

Keeping your credit score high requires a thorough understanding of the factors that influence it. While the exact formula used to convert your financial history into a single number is a closely guarded secret, the factors that are analyzed and the weight they are given is very much public information.

Your monthly credit card balances fall under the “amounts owed” section, often referred to as “utilization,” which accounts for 30% of your score. This number is reported as a ratio of your balances over your credit limit. If you spend $5,000 on a card with a $10,000 limit your utilization will be 50%, but if you spend the same amount on a card with a $20,000 limit, your utilization will only be 25%.

The lower your utilization is, the higher your credit score will generally be. If you’re maxing out all your available credit lines, banks see you as a riskier customer. According to Credit Karma, a utilization ratio of 9% or lower is ideal, though 10-29% is also good.

If you pay your balance before the end of the month, your credit card will report a lower number to the credit bureaus, and your utilization ratio will stay low, improving your credit score. If you’re not in a financial position to pay your bills early, don’t worry! When you do make your payment (usually two to three weeks after), that information will be reported to the credit bureaus and your utilization ratio will come down.

You can even use this strategy to your advantage. If you’re applying for a mortgage or car loan, where a higher credit score can save you some serious money on interest, it might help to pay off all your credit card balances before applying. Not only can this increase your chances of loan approval, but it also might land you a more favorable interest rate.

One final thing to keep in mind is that even if you don’t want to pay your entire balance off before the statement close date, it could be worth paying of a large purchase to avoid a big hit to your utilization ratio. For example, one TPG staffer recently charged $7,000 in expenses for a club party to his Chase Sapphire Reserve and decided to pay it off before his statement closed. His reasoning? Otherwise his utilization ratio on the card would be more than 40%.

Bottom Line There’s no harm in paying off your balances early, and it can even help keep your credit score sky-high. Even if there aren’t any $0 balances being reported to the credit bureaus at the end of the month, your on-time payment history and length of account history will continue to work in your favor building your credit score. Of course, the most important thing is to not miss a payment and begin racking up expensive interest, so as long as you make sure to pay your bill by the due date you’ll be fine.